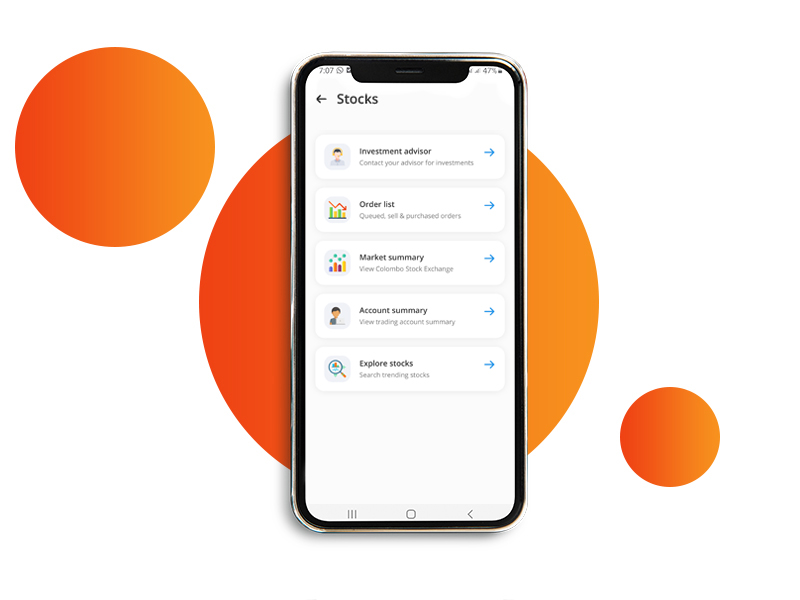

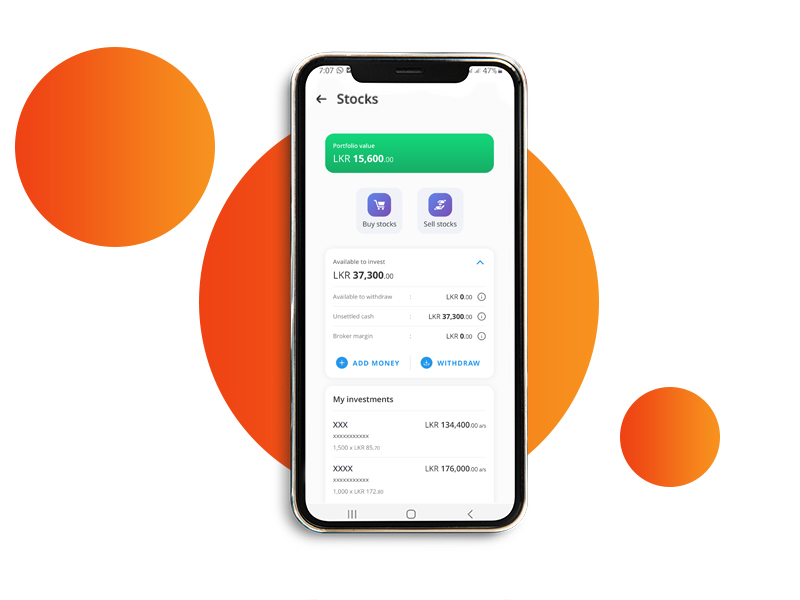

Have you ever dreamt of investing in the Colombo stock market ? Becoming a shareholder has never been this easy ! For the 1st time in Sri Lanka, the genie app brings you a fully digitalized and seamless stock trading experience in partnership with leading stockbrokers. Be it opening a CDS account, buying and selling stocks, viewing market insights or watching your portfolio grow is all now at your fingertips.

Hurry! select “Stocks” on the genie app to enjoy a simple and secure trading experience.